Publications

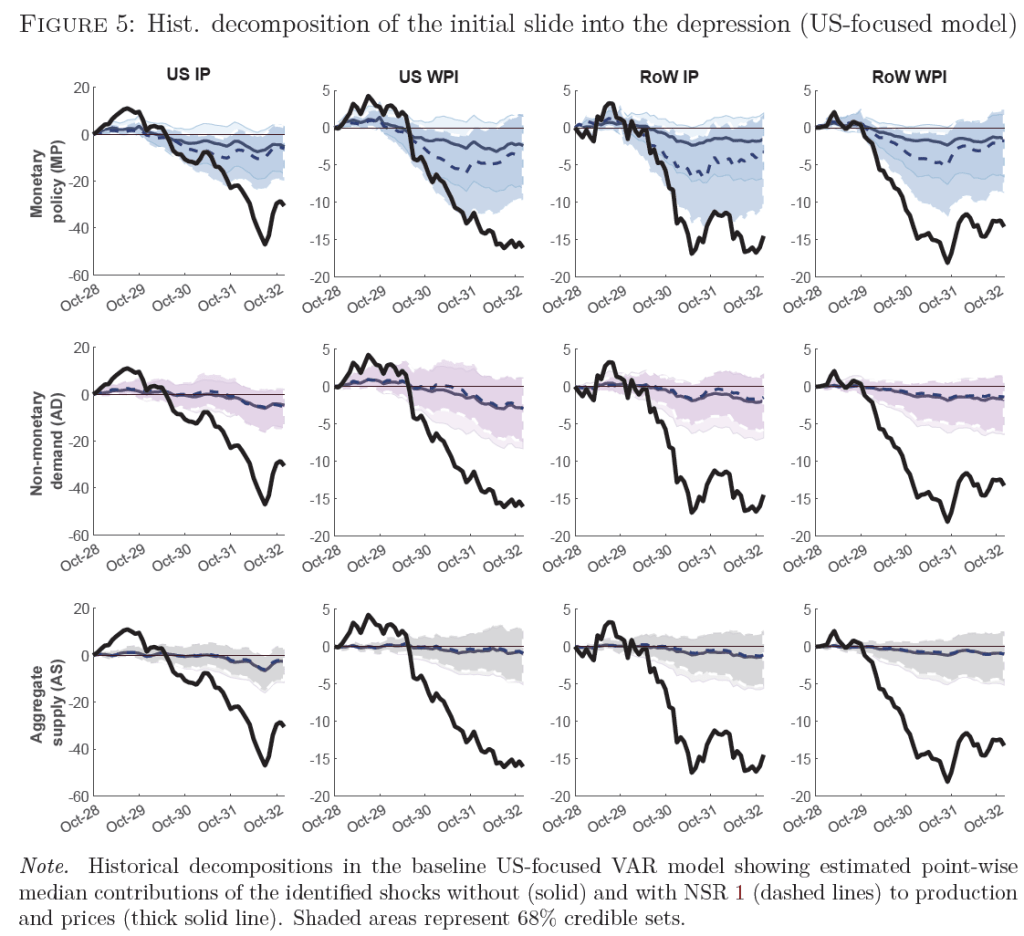

Buried in the Vaults of Central Banks – Monetary Gold Hoarding and the Slide into the Great Depression

European Economic Review, Volume 178, September 2025, 105095

Abstract: I study the role of central bank gold hoarding as a cause for the initial slide into the Great Depression. The notion that monetary forces played an important role in bringing about the depression is well established among many economic historians, but has more recently met some skepticism by formal macroeconometric work. This paper models monetary disturbances as shocks to central bank gold demand, and adds narrative information on key events to sharpen shock identification, while making use of a newly-assembled monthly data set of the interwar world economy. Monetary shocks are found to play an important role in the collapse in prices and output during the initial slide into the Great Depression, whereas non-monetary factors deepened the downturn from 1931 onward.

Journal version, Bundesbank Discussion Paper No. 63/2020, Bundesbank Research Brief 39/2021

Monetary Policy and Bitcoin

Journal of International Money and Finance, Volume 137, October 2023, 102880

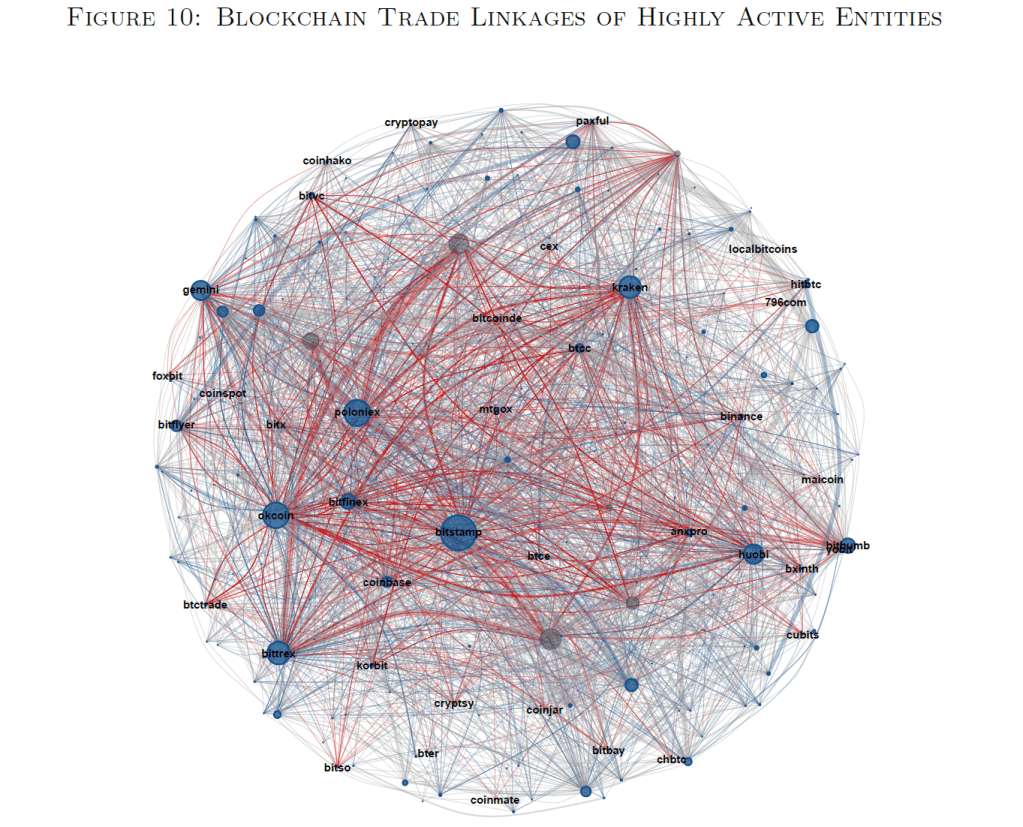

Abstract: I empirically study the impact of monetary policy on Bitcoin, and show that is has evolved over time. First, based on high-frequency data, the paper documents that Bitcoin prices did not immediately respond to US monetary policy announcements in the past; they only started doing so in late 2020, in a manner similar to other risky asset prices. Second, based on a structural VAR analysis I study the impact of monetary policy over longer horizons. I confirm the contractionary impact of a US monetary tightening in the post-2020 time period, but show that, historically, a US tightening used to persistently increase rather than decrease Bitcoin prices. To explain this result, I exploit spreads in Bitcoin valuations across currencies and blockchain data and link increased Bitcoin demand to East Asian economies subject to capital controls, particularly China. I discuss implications for the discussion of where demand for Bitcoin stems from: its recent responses to monetary policy confirm its role as a primarily speculative asset; yet, at least historically Bitcoin seems to have derived part of its value from enabling cross-border value transfers and capital flight.

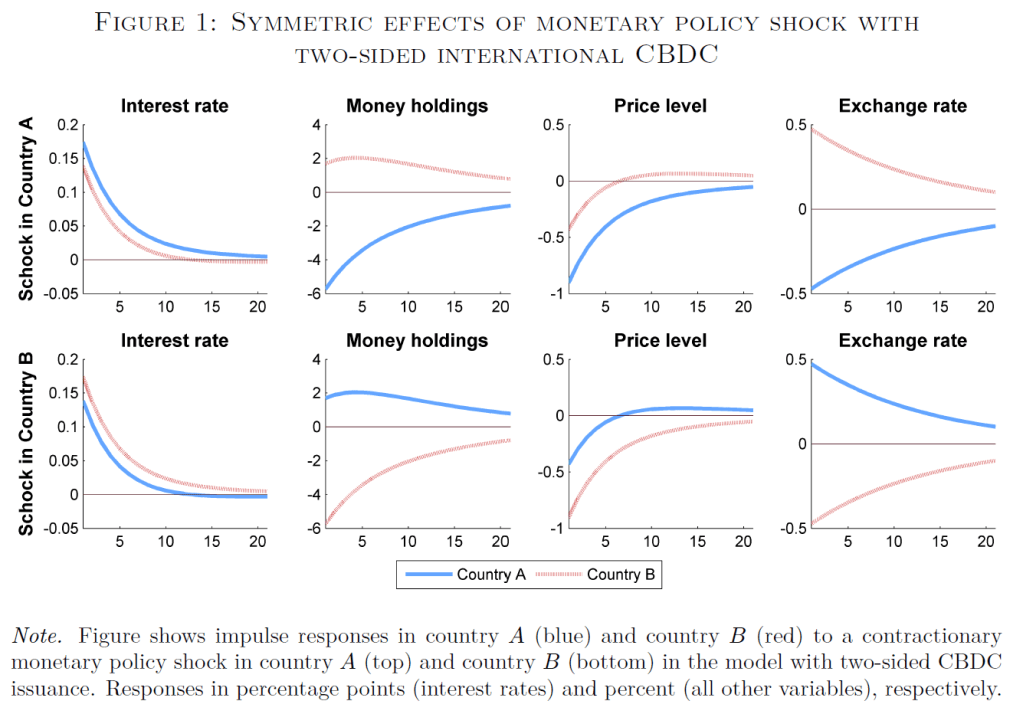

Central Bank Digital Currency Competition and the Impossible Trinity

Finance Research Letters, Volume 54, June 2023, 103723

Abstract: It has been established that in a standard two-country asset pricing model the usage of a privately-issued crypto-asset as a global means of payment leads to the enforced synchronization of nominal interest rates, and hence to a loss of monetary policy autonomy. This paper uses the same framework to show that an identical result obtains in a world in which central banks issue digital currencies (CBDC) to be used abroad. I then integrate the asset pricing conditions into a fully-specified dynamic stochastic general equilibrium model to qualitatively study how shocks are transmitted across borders. In the baseline case, shock transmission is symmetric, whereas it is asymmetric if only one country issues international CBDC or crypto-assets are tied to one currency (stablecoin). I discuss policy implications for the ongoing debate on international aspects of CBDC.

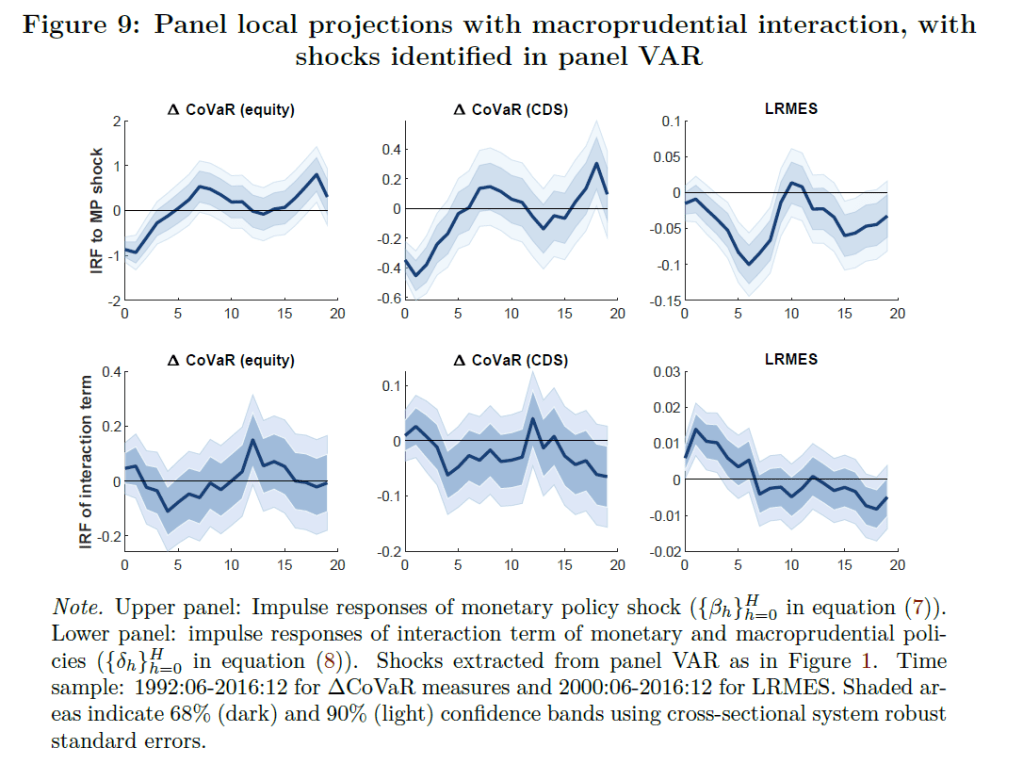

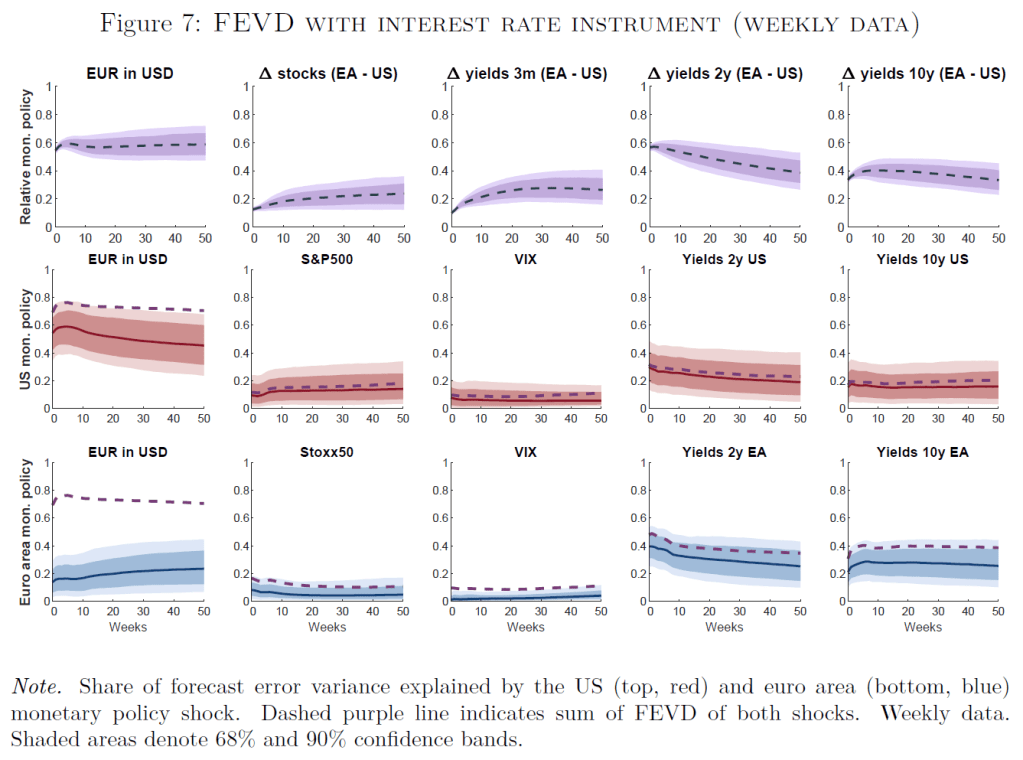

Systemic Bank Risk and Monetary Policy

with Ester Faia

International Journal of Central Banking, December 2021, p.137-176

Abstract: The risk-taking channel of monetary policy acquires relevance for macro policymakers only if it affects systemic risk. We find robust evidence that a monetary tightening lowers systemic risk using cross-country and time-series data in a VAR framework for 29 G-SIBs from seven countries, different risk metrics (ΔCoVaR, LRMES), as well as econometric specifications and identification schemes (panel VAR with recursive identification; proxy VARs using external instruments). We then assess implications for policy. First, we find that both U.S. and euro-area monetary policy shocks spill into other countries’ systemic risk. Second, we document that macroprudential policy plays a significant role in taming the unintended consequences of monetary policy on systemic risk, particularly so for U.S. policy spillovers.

Work in Progress

Daily Macro Shocks

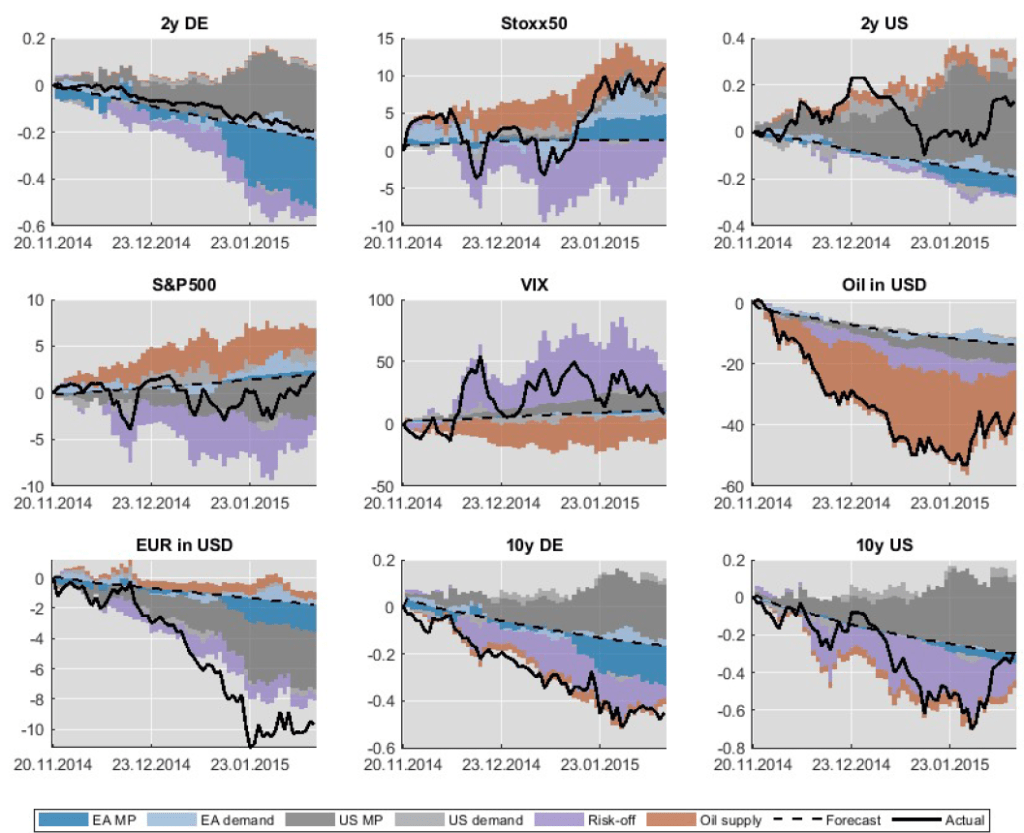

Abstract: I apply instrumental variable techniques to identify a host of macroeconomically relevant shocks at daily frequency in a unified framework from US and euro area financial market data. Instruments are constructed by imposing structure on high-frequency financial market reactions to news. Most notably, supply and demand shocks are instrumented by asset price movements around data releases, where event selection is disciplined by the shocks’ effects on macro variables. A methodological innovation allows point identification of in total seven shocks by minimizing the correlation between them and non-corresponding instruments without imposing strong exclusion restrictions. Results show substantial daily spillovers from US and global shocks to euro area financial markets, whereas euro area spillovers to the US are quantitatively smaller but significant. I demonstrate the usefulness of the framework for policy makers interested in assessing which type of shocks are hitting the economy in real time.

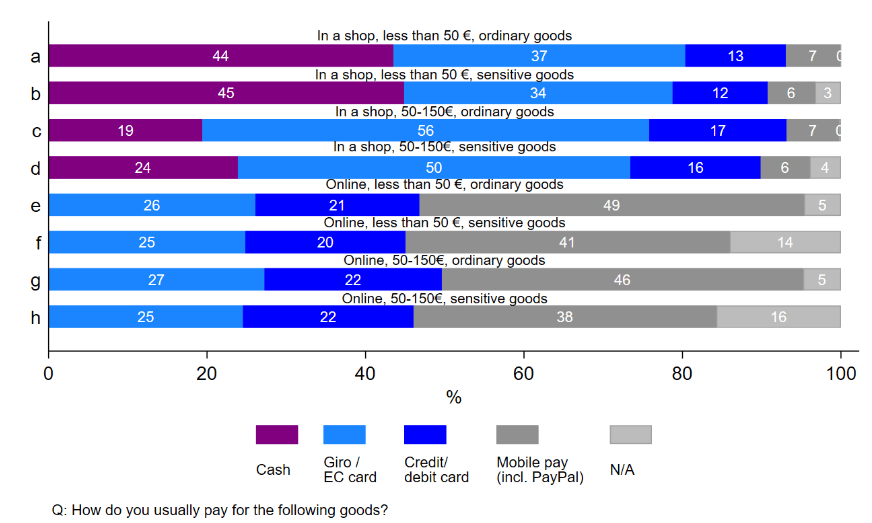

The Role of Privacy in Digital Euro Payments

with Olga Goldfayn-Frank

Abstract: Understanding privacy-related user requirements is crucial for the development of and communication about the digital euro (D€). Would privacy benefits enhance D€ adoption as a payment method? And which dimensions of privacy matter? We study these questions using a survey-embedded randomized controlled trial among German citizens. We find that most respondents show some concern over privacy, and this matters for their payment choice. While there is a negative association between privacy concern and willingness to use the D€ generally, providing information about privacy benefits makes respondents more likely to use it, particularly when it comes to cash-like anonymity.

Relative Monetary Policy and Exchange Rates

Abstract: I show that the majority of short-term nominal exchange rate fluctuations among large economies can be explained by changes in the relative stance of their monetary policies. Adapting recently developed instrumental variable techniques for shock identification, I find that monetary policy shocks of the US relative to the euro area account for 76 percent of the short-term fluctuations of the USD-EUR exchange rate over a one-month horizon – substantially more than previously documented. Similar results are obtained for exchange rates involving the British pound and Japanese yen. Relative monetary policy shocks explain a larger fraction of variability of the exchange rate than of interest rate differentials throughout the yield curve, and small changes in risk-free rates are associated with sizable jumps in the exchange rate. Identifying US and euro area shocks separately reveals that both are important for the USD-EUR rate. Taken together,

these findings speak to the significance of (not only US) monetary policy in driving frictions in interest parity relations that have recently been found to be crucial for understanding exchange rate behavior from a theoretical perspective.

Mining Shocks, Blockchain Security and the Value of Bitcoin

with Emanuel Moench

Abstract: We study the implications of Bitcoin’s security model for its market valuation. We identify mining shocks by exploiting exogenous variation in mining intensity using a narrative approach in a structural Vector Autoregression. While their impact on transaction speed is short-lived, mining shocks persistently affect trading volumes and market valuations,

explaining up to 15 percent of Bitcoin’s substantial price variation. Our findings can be rationalized in a theoretical framework where mining shocks affect the likelihood to withstand potential attacks and as such impact investor beliefs about the future state of the network and thus Bitcoin’s usefulness as a means of payment.

Drifting Apart: Bitcoin and Monetary Policy Pre-Announcement Drifts

Abstract: I document anticipatory effects of monetary policy announcements on Bitcoin prices. There is a positive pre-announcement drift in the price of Bitcoin for ECB Governing Council meetings of almost 65 basis points, but a negative drift of roughly equal size in the hours prior to FOMC announcements. These Bitcoin pre-announcement drifts are not positively correlated with their equity counterparts, the existence of which I document for the same post-financial crisis time sample from 2013 till 2019. There is also no correlation with stock market volatility or Bitcoin price responses to the subsequent announcement. I discuss possible implications of the drifts in cryptocurrency prices for the still unresolved debate on what explains the well-established drifts in equity markets.

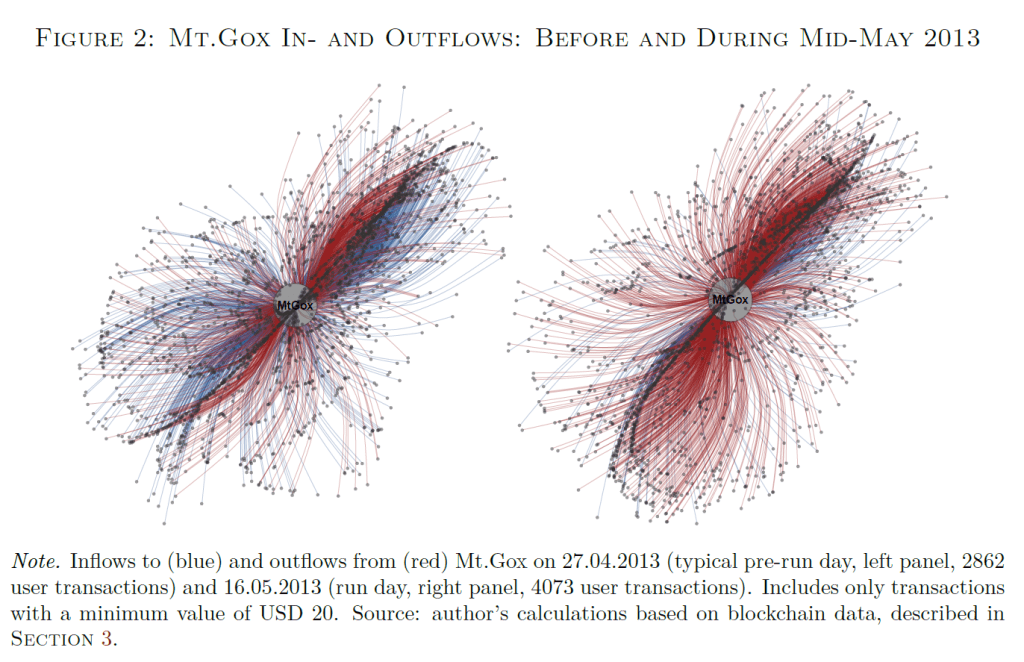

Running Out of Bitcoin? A Blockchain Analysis of a Digital Run

Abstract: I study the behavior and characteristics of depositors who withdrew sizeable sums from their accounts at a large Bitcoin exchange in May 2013. The paper rationalizes how an exogenous regulatory event made it known to market participants that the exchange was operating under fractional reserve, giving rise to run risk. I then conduct an empirical analysis based on blockchain data in order to understand the determinants of run behavior in the new and unregulated environment of cryptocurrency economies. I find that most of the withdrawals are due to a relatively small number of depositors who get out in a short period of time but are comparatively passive some time before and after the run. Regarding user characteristics, I find that the length and depth of the trading relationship with the exchange matters, that more experienced and sophisticated users are more likely to run and that there is some tentative evidence of network effects in running.